-

Auditoría de estados financieros

Servicio de Auditoría de estados financieros realizado por la firma contable mexicana Salles Sainz Grant Thornton.

-

Dictamen fiscal

Nuestra gente está comprometida a ofrecer los más altos estándares de excelencia, con integridad, amplios conocimientos técnicos y experiencia comercial.

-

Normas Internacionales de Información Financiera

Ayudamos a nuestros clientes en el proceso de adopción de las Normas Internacionales de Información Financiera.

-

Consultoría y asesoría fiscal

Encontramos las mejores herramientas dentro de las diversas disposiciones fiscales

-

Seguridad social y contribuciones locales

Seguridad social y contribuciones locales

-

Consultoría Fiscal Internacional

Consultoría Fiscal Internacional

-

Prevención y detección de lavado de dinero y prácticas anticorrupción

Prevención y detección de lavado de dinero y prácticas anticorrupción. El Lavado de Dinero es un proceso especializado y con frecuencia complejo de identificar

-

Consultoría de negocios

Comprendemos su organización para ofrecer soluciones que impulsen su negocio orientado a los resultados

-

Tecnología de la información

Basamos nuestra filosofía de trabajo en el conocimiento de negocio de nuestros clientes, atención personalizada y de alta calidad en nuestros servicios.

-

Generador de avisos para actividades vulnerables

Enfocamos esfuerzo y concentración en análisis profundo y decisiones respecto a operaciones sospechosas y a un adecuado cumplimiento de la Ley

-

Consultoría de riesgo

Las empresas de todo el mundo se enfrentan a constantes desafíos en su intento de navegar por la amplia gama de riesgos en complejos mercados globales

-

Consultoría Forense

En tiempos definidos por la incertidumbre y las amenazas a las organizaciones, los profesionales forenses de Grant Thornton han apuntado soluciones para retos difíciles

-

Recuperación y reorganización

Nos centramos en la identificación y resolución de problemas que afectan a la rentabilidad, la protección de valor de la empresa y su recuperación

-

Consultoría Transaccional

Podemos ayudarle a entender los detonantes de valor detrás de transacciones exitosas

-

Prevención y detección de lavado de dinero y prácticas anticorrupción

Certificados por la CNBV en materia de prevención de operaciones con recursos de procedencia ilícita y financiamiento al terrorismo

-

Auditoría Interna

Todas las organizaciones administran el riesgo basándose principalmente en el control interno para ayudar a minimizarlo

-

Auditoría de Cumplimiento al Sistema de Pagos Interbancarios en Dólares (SPID)

Contamos con procedimientos y una metodología para ayudar a las empresas del sector financiero a cumplir con las reglas y procesos operativos

-

Implementación de COUPA – Compras y Gastos

Le proporcionamos una única solución integrada desde compras hasta gastos

-

Servicios para Empresas Familiares

Nuestro equipo está preparado para ayudar a las empresas familiares a crear su protocolo familiar, teniendo experiencia amplia con numerosas familias mexicanas en diferentes estados de la República.

-

Gobierno Corporativo

Salles, Sainz – Grant Thornton, S.C. tiene amplia experiencia en la prestación de servicios de Gobierno Corporativo, basando su filosofía de trabajo en las mejores practicas corporativas, el conocimiento del negocio de nuestros clientes, atención personalizada y de alta calidad en nuestros servicios.

-

Organización, Cultura y Gente

En Salles, Sainz – Grant Thornton, S.C. apoyamos a nuestros clientes a definir y desarrollar sus funciones de capital humano minimizando los riesgos existentes y considerando las dimensiones cambiantes de la fuerza de trabajo.

-

Consultoría de tecnología de la información

Salles Sainz Grant Thornton, S.C. tiene amplia experiencia en Consultoría de Tecnología de Información (TI), basando su filosofía de trabajo en el conocimiento de negocio de nuestros clientes, atención personalizada y de alta calidad en nuestros servicios.

-

Auditoría de Cumplimiento al Sistema de Pagos Interbancarios en Dólares (SPID)

El área de Business Advisory Services presta servicios de consultoría integral en diversas materias como TI, operativa, ISO, entre muchos otros, lo cual nos ha permitido tener una experiencia sólida en diversos sectores incluyendo el financiero.

-

Implementación de COUPA - Compras y Gastos

En Salles Sainz Grant Thornton, S.C., entendemos cuales son los elementos que requieren las organizaciones para afrontar los retos que demanda una administración eficiente de compras y gastos y cómo podemos ayudarle a la mejora de la gestión de las compras y gastos

-

Administración de riesgos

El área de Business Advisory Services de Salles, Sainz – Grant Thornton, S.C. apoya a las organizaciones en la conexión del pensamiento de riesgo con su negocio u objetivos estratégicos, así como la actividad de gestión cotidiana.

-

Valuaciones, fusiones y adquisiciones

El área de Business Advisory Services de Salles, Sainz – Grant Thornton, S.C. ayudamos a nuestros clientes a navegar transacciones complejas - ya sea comprando o vendiendo - con velocidad y agilidad, desde el diseño de la estrategia de la transacción hasta el desarrollo del due diligence y la integración de un nuevo negocio o la separación de una entidad, apoyamos a nuestros clientes a aprovechar oportunidades, resolver problemas y administrar riesgos para liberar su potencial de crecimiento.

-

Control Interno

En Salles, Sainz – Grant Thornton, S.C. trabajamos con entidades de diversos tamaños y sectores. Optimizamos los esfuerzos para alcanzar sus objetivos con la aplicación de los estándares y metodologías más elevadas de Control Interno, Administración y Gestión de Riesgos.

-

Investigaciones Forenses y Disputas

Combinando técnicas y habilidades de investigación avanzadas, métodos de tecnología forense y un amplio conocimiento de la industria, Salles, Sainz – Grant Thornton, S.C. cuenta con profesionales especializados que ayudan a nuestros clientes y sus consejeros legales investigando las acusaciones de fraude y a responder ante los accionistas y autoridades.

-

Contraloría externa

Factor clave en su estrategia de administración de negocios, ya que es una herramienta efectiva que potencia los beneficios de la pequeña y mediana empresa

-

Capital Humano

Proveemos soluciones para su empresa para encontrar y retener el talento en ella.

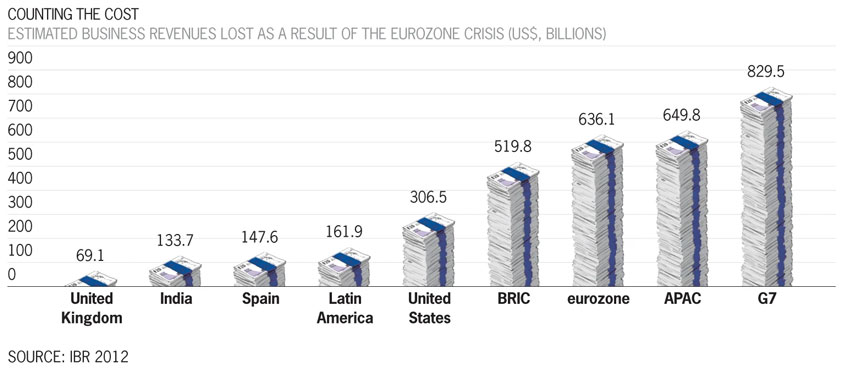

Estimating the business cost

Monday night’s news that international lenders had reached an agreement on how to remedy Greece’s bailout programme, thereby releasing a delayed €34.4bn aid payment, was an important step for the future of the eurozone. But as the crisis drags on and growth rates continue to disappoint, the cost to businesses keeps on rising.

Last week we released estimates of the impact of the eurozone crisis, which indicated that it had wiped over US$2.2trillion off revenues globally.[1]

This is a staggering number. But it does not stop there.

Business revenues in the eurozone are estimated to have dropped by around US$636bn (or 2.6% of total revenues) as a result of the crisis. Businesses in Spain have been hit even more severely: the estimated US$148bn loss is equivalent to 5.5% of total corporate revenues.

And in an ever more globalised world, businesses outside the eurozone are counting the cost. Businesses in the UK are estimated to have lost US$69bn (1.4% of total revenues) whilst across the Atlantic, business revenues in the US are estimated to have dropped by US$307bn (1.0% of total revenues).

Lower revenues squeeze profit margins meaning businesses have less flexibility to invest in their workers, their buildings, R&D, new plants or machinery. In other words, the long-term growth prospects of both their operations and their economy suffer.

Just as pertinently, 17% of businesses globally – rising to 25% in China – now say they are less likely to do business in Europe as a result of the crisis. This compares with just 10% when businesses were asked the same question about the Middle East & North Africa in 2011 following the Arab Spring.

Overhauling Greece’s bailout programme is welcome news, but eurozone leaders should be wary of the short and long-term damage the crisis is doing to regional business growth prospects. A resolution is needed. Fast.

To access the data, please go to our data visualisation tool.

[1] Businesses negatively affected by the eurozone crisis were asked: “By how much has your revenue fallen as a result of the eurozone financial crisis?” Total impact was then calculated at the global level using the ratio of US and UK corporate revenues to GDP of approximately 2:1.